Bracknell Labour Serving you here

Speech for full council re budget

It is good to see the huge increase in numbers of responses received to this year’s Budget Consultation and to see that the responses have been considered, resulting in changes made to the budget proposals

The taxi drivers are to have their disclosure and debarring fees reduced and the library savings are to be found elsewhere, now enabling the current levels of opening hours staffed by librarians to be retained.

The budget consultation documents also included details about a change in the management of the libraries- to be run by Community Management Companies- I think this means, run similarly to the Community Centres by volunteer groups. This is assumed from an included statement that if a particular church group runs a library, then other denominations, or groups might be deterred from using that library. This can be found in the Consultation Budget Equality Assessment papers

No cost savings were included in the main part of the budget papers but if this is a proposal for the future, then the consultation must involve public meetings in each of our communities, with officers and executive members explaining and listening to residents-as happened when Open plus was first proposed- about 6 years ago. Maybe the inclusion of this paper was a mistake.

It must surely have been a mistake to include the Internal Insurer’s risk assessment dealing with the expenditure for Garth hill College in the public papers. The detail, open for all to see, included information which was harmful to the Council as well as to the school.

In the Equality Assessment Papers there is also a suggestion to cut the bus that enables adults with learning difficulties to attend social activities safely, being picked up and returned by a door-to-door service. This service provides much needed respite to their carers as well as overcoming social isolation for the participants. The use of this bus may have been negligible in the past, two years but it is needed now more than ever. I could find no reference to this within the budget papers either. So hopefully, this too has been wrongly included.

For the past three years, I have suggested, in vain, that the Budget Papers are read thoroughly before publication so mistakes can be corrected before publication.

As for the budget itself:

The Provisional Local Government Provisional settlement has now been published.

Government funding to Local Councils was increased but this increase also assumed all Councils would raise their Council Tax to the maximum permitted level to cover any future Covid-costs, funding for adult social services and children social care, and the increased National Insurance payments for every Councill employee.

These budget Proposals indeed raise the Bracknell Forest Council Tax by the maximum 0f 4 .49%

The costs for providing Adult Social services and Children Social Care dominate the pressures for this Council, as they do for every other. These are costs that should be covered directly by government and not Local Councils. In Bracknell Forest most of the properties are rated Band C and above, every 1% rise in council tax brings in £677K. In areas where most homes are A – C rated the return is very much less – but the needs are still the same.

Using Council Tax to cove the increasing costs in Social Care is a postcode lottery. This cannot be fair or equitable. Nor can it be sustainable in the long term. Central Government should resource this with adequate increased relevant funding.

Throughout the budget papers there is reference to grants. Some of these are ring fenced but others have to be competed for. Preparing bids for this money is time consuming and costly. BF has a good record of success but when its bid fails, all this time and effort is wasted. There must again be better ways of funding these projects than having to compete with other Councils from the same pot, for ever resulting in winners and losers.

The Budget for schools is ring fenced Schools will also have to pay the huge increases in gas and electricity costs and predicted 7% inflation costs on all resources. The increase due to the 1.25% National Insurance increase is said to be further funded by the Gov. but there is no such promise to cover the yet unknown pay awards. The number of children requiring support with therapies, one to one counselling and other interventions, some because of Covid, is also increasing. Youth Line, The Wyaz Youth Club and PC Ian Gregory are doing a superb job, especially in our secondary schools, but more is needed. All these cost!!

Schools are funded by the number on roll, and the falling numbers of primary school children is very concerning.

The biggest pressure for school funding is in support of those pupils who require SEND and especially those with the most challenging educational requirements- the High Needs Block. Again, the money received does not cover the cost of the provision. The |Budget states that the High Needs deficit will be funded from the Schools Earmarked Reserves. The deficit has been accumulating for years and by 2023 it is estimated to be £20m. There is no such funding in any earmarked reserves. This

is a National Issue and the Government has recently introduced a more vigorous monitoring and intervention programme. It has given a 3-year time limit to getting this deficit under control and to manage any accumulated deficit from their own resources by April 2023 – £20m by 2023!

This was raised by the Head Teachers at the Schools Forum and concern was expressed that there was no accompanying paper outlining the plans re finding this money to meet this deadline.

We accept that many Bracknell Forest primary schools now have extra provision for SEND needs but many of our children are still having to attend out of area schools, with the accompanying transport costs. The proposed new SEMH school is not mentioned here at all, although it was included in the last two budgets.

Schools work hard to prevent any of their students leaving without going into employment, training, or further education- becoming NEET. Extra money was provided to support this for the past two years, but this has now been withdrawn. Yet the numbers- as discussed at the last Overview and Scrutiny Panel are concerning. Less money means less support, fewer successful outcomes. This intervention is essential is helping the life chances of these young people.

In the Labour Group’s response to the budget, there are proposals that we fully support Particularly, Heathlands; and the Social Care Resourcing Campaign an initiative to attract permanent staff and reduce the reliance on agency workers.

There is no mention of funds to support South Hill Park, but we assume this is because there is no change, and the £194 K remains.

At the last Council meeting, the Council were told that £180K had been allocated towards a Financial Hardship Fund. I can find no mention of this in the budget, but it will certainly be needed. With huge energy costs, predicted 7 % inflation, National Insurance costs,

The new inclusion of the Papers on the Financial Support for low-income Households in these budget papers -Annex H is very welcome, detailing the allocation of funds received from the Government because of Covid-19. We support the continued use of the Government Covid-19 grant to provide £100 Council Tax reduction for low-income households and the fixed two-year post to provide targeted outreach work, enabling our most vulnerable families to access all existing support.

We also welcome the three-year commitment by the Government to fund holiday activities and the food programme, so, so needed.

The Government funded £150 to cover increased costs, for all households in A-D properties is also welcomed but this will not help those in rented accommodation who pay their council tax as part of their rent. The landlord will get the £150, but the tenant will still pay the increased costs. What measures will be taken to ensure the tenants receive the benefit?

£300K in the Capital Budget and £25k in the Revenue budget have now been added for ‘Borough Greening’- to improve the maintenance of the Borough and making some areas less scruffy.

For Councillors who represent wards with few drives and houses built around squares- this screams out as purpose-built PARKING areas. We had Verges- now trenches of mud. Gone are the days when each family had one car. Multiple occupancy properties often have more than 5. I am not the only Councillor that mentions ‘parking’ as their residents’ main concern. Being able to find a place near their home without having to worry about losing this spot should they ever dare to go out. There must be a way to make this better. In the past, new parking bays on our estates have been joint funded -£100K from the Council and £100K from Silva Homes.

Silva Homes are now looking to use their money to invest.in reducing their carbon footprint- ways of installing EV charging areas for their residents. All very laudable but the parking problems exist now and is the major concern for many, many residents.

60 roads have been named throughout Bracknell as needing extra parking.

We therefore propose that an extra £100K be allocated to find solutions., to provide some of these bays and improve the verges so that there can be parking but without the destruction. Where there is a will, there is a way. Estates in other towns do not look like ours

We are fully aware that balances can only be used once but the balances are large. The Government has promised a Fair Funding Review, business rates reset and a review of the New Homes Bonus. We are told that none of these are likely to benefit Bracknell Forest, resulting on a possible recurring budget gap of £4m. Balances will be needed to safeguard against any such reduction in the future. We understand much has been put aside in fear of future cuts from the Government but £19.924m in the Future Funding balance; £13.247m in the ‘Revenue grants unapplied balance’ £7.5m in the Business Rate Revaluation balance; £4.512m in the Business Rates Relief balance; £9.551m in the ‘general balances’- and £25.856m in other earmarked reserves.?

The Labour Group has never and will never ask for all these balances to be used but times are hard for all our residents not just those in Band D and below.

The Council Tax will have to be raised to cover the NI contributions and the Social Care demands, but it cannot be raised the full 4.49% in this year of all years. Every resident is being hit be they mortgage payers or rent payers. We totally understand the Majority Group’s reasoning – Maximum possible Rate Now- – Lower rate next year- 2023-the Year of the Bracknell Forest Council Elections.

BUT Many of our residents are needing help right now.

Last year an £18.2m cushion in the Future Funding reserve was said to be adequate to safeguard the Council from future risks. Last year a 3.49% rate rise was deemed sufficient.

Now the balances have increased, and interest rates are rising.

So,

If it was sufficient for last year, it must be sufficient for this- the hardest year any of our residents have experienced for a very long time.

This Council rate – 1% less than the maximum permitted- would show the Council understands, has listened, heard, and acted

I therefore move the following amendment, which will limit the council tax increase to 3.49%, £1 a week for Band D properties, as well as making available additional funding to help solve some of the parking issues in our estates:

LABOUR GROUP AMENDMENT TO RECOMMENDATIONS SUBMITTED BY THE EXECUTIVE IN RESPECT OF AGENDA ITEM 6

This Council supports the recommendations submitted by the Executive in respect of the Capital Programme 2022/23 – 2024/25 and the Revenue Budget 2022/23 as set out in pages 19 and 20 of the agenda, with the following amendments (highlighted in bold).

2.2 Revenue Budget 2022/23

i) The budget proposals set out in Table 1 (page 3) of the summary report for Council, subject to the changes identified in sections 3.2(pages 4), 3.3 (pages 4 to 5), 3.4 (pages 5 to 7), 3.6 (pages 7 to 8),3.9 (pages 9 to 11), 7.2 (page 20) and 7.3 (page 20) of the report, plus an additional one-off pressure of £0.100 for improvements to parking on our estates be agreed.

v111) A contribution of £1.560m (after allowing for additional interest from the use of balances) be made from revenue balances to support revenue expenditure; – This is comprised of £ 775K already included in the core budget; an extra £677K to cover the reduced Council tax and some for lost interest

x) The Council’s Council Tax requirement, excluding Parish Council precepts, be set at £70.065m

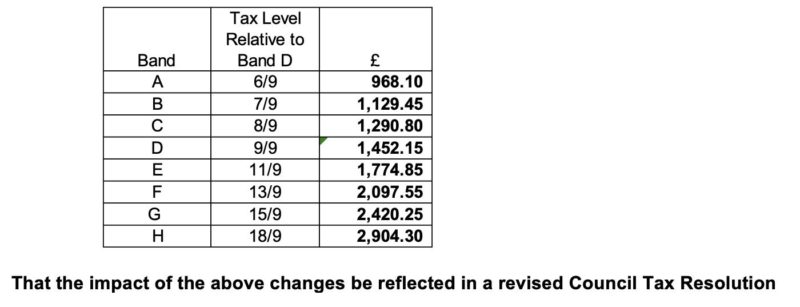

xi) The Council Tax for the Council’s services for each Valuation Band be set as follows:

We lost the amendment

- 32 Tories voted against

- 4 Labour Voted for

- 1 Councillor abstained because of loss of link to the meeting